Finding the courage to seek debt advice is often the largest hurdle to jump. Make it easier by using Angel Advance’s Online Debt Advice tool – no telephone call needed.

What is it?

Online Debt Advice is a tool created by Angel Advance for anyone in the UK who wants to understand any debt solutions that are available to help them take back control of their situation – without speaking to anyone. We offer online advice on Debt Management Plans, Individual Voluntary Arrangements, Debt Relief Orders, Bankruptcy, Sequestration (including minimal asset process), Debt Arrangement Scheme, and Trust Deeds.

If the information you provide suggests a solution doesn’t suit you, but maybe a lifestyle change does, we’ll let you know.

What do I need to know?

To be able to receive advice online, you will need to share some information about your situation; it is important that the information is as accurate as possible to ensure you receive the best outcome.

The information needed consists primarily of a budget plan and a list of your debt(s). The hardest part of receiving debt advice can be finding the courage to speak to someone. With our tool, you won’t need to speak to anyone on the telephone if that’s your preference.

Our online advice tool guides you through 5 simple steps. Find our guide below to prepare for your advice and make sure you have everything to hand:

Step 1: Your situation

We will ask some questions about your situation at home; this helps us build a better picture and needs to be factored into your advice. This includes:

Step 2: Your debts

We need to know about any debt you have, even if you feel you are managing it.

Include:

If you can’t locate all your debts, check your credit file across the three agencies:

You can request your free statutory credit report – without signing up to their services. If, however you do prefer to sign up to one of these services, most offer a free trial, just remember to cancel it before you’re charged at the end of the free period.

Also check through any post, search your emails and even bank statements for old payments you may have made.

We need at least a rough idea of what you owe to be able to offer advice, as your debt level effects the solutions you qualify for.

Step 3: Your budget plan

Step 3: Your budget plan

Many of us live within our means and when change happens, it can be difficult to adjust, which is often a reason for a debt spiral to begin. Debt solutions are there to help with better budgeting and to improve your situation by managing your debt effectively, so it is essential that the budget plan you put together is sustainable and fair.

Your budget plan is to help establish whether you can afford to pay a contribution toward your debts each month, this in turn helps determine which solutions you qualify for. Some debt solutions have a minimum payment requirement, others have a maximum, so it’s important that we have the correct details when offering you debt advice.

You’ll be asked when beginning your budget plan whether you wish to provide the household details or individual. Our suggestion is to present a household as this allows us to offer better budgeting advice and more in-depth debt advice too.

It’s always recommended to do complete online debt advice with your partner, especially if they have benefited from the debt. The best option may be a joint solution which gets both of you debt free quicker and at a lower cost.

If doing this, please ensure you cover all household expenses too. If your partner isn’t aware of the situation or you manage your money separately, it may be best to provide your details alone.

It can be difficult to build a budget plan after having spent time battling with debt repayments. You may have found that you had nothing left after paying the repayments, then found yourself using the credit facilities to make ends meet for the rest of the month.

It’s initially going to be difficult to stick to the budget plan, but don’t feel defeated straight away, you can work towards it and discover new ways to reduce your outgoings and manage more effectively, without the use of credit.

Things to remember:

Step 4: Final Checks and Changes

After completing your budget, you’ll need to confirm a few details that we use to establish if anything about your situation could impact the advice we provide.

Examples may be:

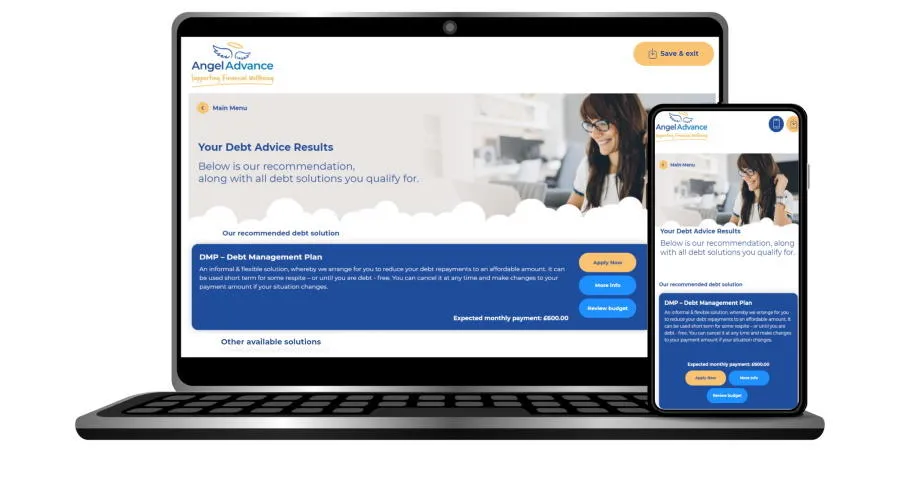

Step 5: Your Debt Advice Results

You’re done! Once we have all relevant information, we’ll present a breakdown of each solution you qualify for. We’ll compare and suggest the solutions using the overall cost and timescales involved. It’s important you take some time to read through each option, even if you thought that you might not like that option beforehand. You’ll see examples of advantages and disadvantages, including some information that is tailored to you, and the impact the solution would have on your situation.

What if I have nothing to offer to my debts?

It’s time to consider all the options you have. This could be a debt solution, trying to increase your income, or making some cutbacks to reduce your outgoings.

Have you boosted your income to its maximum? Check out our benefits calculator for any benefits you may be able to access that will top up your current earnings. Maybe it’s time to look for a second job or ask for that pay rise you’ve been putting off for a while at work! Can your older children offer a board contribution to help with living costs, or can you sub-let a room of your home with permission from your landlord? Be sure to read through some tips here before considering subletting.

Have you cancelled any non-essential outgoings? Check your bank statement for any costs that you don’t really need or could sacrifice to be able to afford a payment toward your debt.

Some debt solutions may offer a short-term fix, but you need to consider how you’re going to manage moving forwards. The idea of your debt being written off in a solution like Bankruptcy or a Debt Relief Order may sound tempting, but if you don’t have enough to cover your basic household bills and living expenses without using credit, the chances are, it’s not the best way out.

I’m ready to apply for a debt solution online – What next?

Well done, we appreciate how difficult this may have been. The hard work is now done, and you’re left with a short application process that takes a few minutes.

Depending on which solution you’re applying for, the process is slightly different, but all equally easy!

We offer Individual Voluntary Arrangements (IVA), Debt Management Plans (DMP) or Debt Relief Orders (DRO) and each solution has different requirements, please look below for more information relating to your preferred solution.

Our Online Debt Advice tool will refer you to the relevant organisation if you qualify for a solution that we don’t offer in-house. You can also refer to Money Helper.

Apply for a Debt Management Plan Online

We’ll need to confirm some details with you, such as contact details, payment information, specific creditor information, and that you’re happy for us to complete an online verification check. If there are any issues checking your identity electronically, we’ll contact you to ask for some documents. It may just be that we need some photo ID or proof or your address.

If you’re applying for a joint Debt Management Plan, we’ll need to speak to of you to ensure you’re both fully aware of the solution and how it’ll be managed for you. This will be arranged to suit you and take a few minutes; you can book the appointment online.

Debt management plans require you send in copies of recent bank statements to verify the budget you have proposed. We understand that it may take a couple of months to get your new budget in place, so your current bank statement may not reflect your new budget. So we ask for you to send a bank statement to us within the first 3 months of your plan being opened.

This helps us verify the finer details, making sure your payments are affordable and that we’ve accounted for any niggly bills that may crop up. It also helps with the repayment offers being accepted. If creditors are confident that your budgets are accurate, they’re more likely to accept a repayment offer.

Apply for an IVA online (Individual Voluntary Arrangement)

We’ll need to confirm some details with you, such as contact details, payment information, specific creditor information, and that you’re happy for us to complete an online verification check. For an IVA, 3 months’ proof of income and bank statements are needed as a minimum, so it is a good idea to start getting those together ASAP. You can upload them online or email them to us. We’ll also need proof of each debt, so gather any screenshots of the online accounts or statements you’ve been sent. If you’re struggling with proof of your debts, please get in touch as we can often support you in obtaining this, if you know who the creditor is.

Apply for a DRO online (Debt Relief Order)

We’ll need to confirm some details with you, such as contact details, payment information, specific creditor information, and that you’re happy for us to complete an online verification check.

For a DRO, we’ll need 3 months’ proof of income and bank statements as a minimum, so it’s a good idea to start getting those together ASAP. You can upload them online or email them to us. We’ll also need proof of each debt, so gather any screenshots of the online accounts or statements you’ve been sent. If you’re struggling with proof of your debts, please get in touch as we can often support you in obtaining this, if you know who the creditor is.

Solutions for Scottish Residents

If you’re a Scottish resident and want to apply for a Scottish solution, pop in your details and book an appointment. We’ll arrange for our partners in Scotland – KPMG, who specialise in Scottish solutions – to call you and discuss your options. With your consent, KPMG will have access to your full assessment via our platform. This means your application into any solution with them will be as quick and simple as possible.

I don’t want a solution, just budgeting advice online

Our online debt advice tool can be used by anyone, even if you don’t think you need a specific debt solution, but just an idea on your spending and whether it’s realistic for your situation and family. It will tell you if your spending is too high or too low and you can then use our budgeting advice page for some tips on how to improve your spending. It will also offer you a solution, providing you qualify for one, this may offer you some relief knowing your budgeting is not the problem, and a debt solution can help.

At the end of the journey, you also get a full copy of all your details and budget plan – sent to your email in a PDF.

Frequently asked questions

When you complete your bankruptcy application, you will need to make a list of your assets which the official receiver will take control of when your application is approved.

There are certain things which you will almost definitely lose, such as any savings that you have, including investments (but not your pension). You will also lose any high value items which aren’t essential, like a caravan.

The Official Receiver (OR) won’t take anything which is essential for work, or your household items like your cooker, washing machine, fridge, furniture and bedding. They also won’t take anything which doesn’t belong to you (like your children’s possessions, or a car that you drive which is owned by your partner). Only assets which can raise a reasonable amount to pay your bankruptcy costs and creditors will be taken, so you won’t need to list anything worth less than £500. You should also consider that this is the re-sale value, not what you bought it for.

Contact us! Our advisors deal with a vast range of personal situations and no question will surprise them. You can email us at: info@angeladvance.co.uk

Most of our solutions and advice can be offered via email or entirely online, however, there may be a situation where a phone call could be beneficial. It could be that your creditor requires an urgent update from you, and we think it would be quicker to call you rather than email. We also use SMS where possible, as not everyone monitors their emails frequently.

We need your address to be able to pass security questions with your creditors. We’ll also need any recent addresses too, as they may have old information stored. If you don’t want post delivering to your address, we can prevent this from happening and already do our best to be as paperless as possible, so will usually email any documents across to you, unless you request them in the post.

We need to understand how much you owe and what type of debt you have, to be able to offer debt advice. If you’re not sure who you owe money to, you can call the companies, explain you’re getting some help with your debts and ask if they hold any of your details on their databases. Also, checking across the credit reference agencies can be useful and searching old correspondence you may have.

The faster we have all the necessary details, the faster we can set up your solution. Some solutions such as an IVA and DRO can take a few weeks due to the level of detail needed, and the need for a specialist advisor to manage the process. We often set up Debt Management Plans within 24 hours of an application being submitted, provided we have all information.

There are many people who feel the same way as you, and providing you’re making this decision for all the right reasons, we’re more than happy to support you with this. It’s your choice, after all. There are many reasons you may opt to enter an IVA rather than go Bankrupt, such as there being no upfront cost, your tenancy agreement states you can’t be Bankrupt and many others.

This happens quite a lot. If you meet the strict criteria for the DRO, we’d suggest exploring this first, as it’s much cheaper than Bankruptcy. If our Approved Intermediary discovers a potential issue with the DRO being suitable, we’ll discuss this with you and let you know what you should do next.

Yes. You might be against the idea of being insolvent or feel that you really want to have a go at paying back all of your debt, and this is OK. Our main goal is to provide you with all the information you need to make an informed decision and be confident that it suits you. A Debt Management Plan is flexible and can be used as a short-term measure whilst you explore other solutions, and can be cancelled at any stage, should you wish, in the future.

When entering a solution, you’ll either be stopping payments or reducing them to suit what you can afford. If you have a credit card, loan or overdraft with your bank and will be adding it to your solution, we advise to open a new account with someone you don’t owe anything to. This is due to the right of off-set, which essentially means that if you have a positive balance in your current account and fall behind with one of your debts, they can take the money to cover what’s owed. It’s very rare, but there’s always a risk.

It’s strongly advised to stay clear of credit when in any solution, in certain solutions, it is prohibited and would cause the solution to fail, or worse.

If you get to a stage where you feel you really need a credit option, please speak with your provider; they’ll be able to support you and prevent issues cropping up that impact your solution.

If you’re not an existing customer and feel that you need further debt advice, you can use our online tool by using the link at the bottom of this page.